Introduction When you apply for a home or vehicle loan, lenders look at your credit history to determine ..

Keep reading

You don’t need a perfect credit score to get a mortgage. In some cases, the score can be in the range ..

Keep reading

Are you looking to apply for a personal loan at a lower rate? You are not the only one looking to do that. ..

Keep reading

Loans give us instant cash to pay for expenses when we need them. There are several types of loans you can take, ..

Keep reading

People invest in a property to either save their money or earn money by selling it at a premium. And there ..

Keep reading

In the last decade, the number of divorce cases has sharply risen that nobody gives a toss to it. Nobody ..

Keep reading

There is an inclination towards taking help in finances. Of course, you cannot always stay on the rosy ..

Keep reading

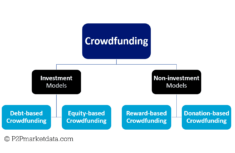

In case you’re an entrepreneur, it’s probable that you’ve heard of crowdfunding. But, you possibly ..

Keep reading

Introduction Have you ever asked yourself if you’re making the most out of your credit card? Are there ..

Keep reading